Hey there tech enthusiasts! Have you ever wondered how the fluctuation of cloud share prices can affect technology companies? Well, you’re in the right place! In this article, we will delve into the profound impact that cloud share prices can have on the performance and strategies of various technology companies. From industry giants to up-and-coming startups, the price of cloud shares can make a significant difference in the competitive landscape of the tech world. So, let’s explore how this lesser-known factor can play a crucial role in shaping the future of technology businesses.

Factors Influencing Cloud Share Prices

Cloud share prices can be influenced by a variety of factors, both internal and external. Understanding these factors can help investors make informed decisions when it comes to buying or selling cloud-related stocks. One key factor that can impact cloud share prices is the overall performance of the company offering the services. If a cloud provider has a strong track record of growth and profitability, investors are likely to be more confident in its future prospects, leading to an increase in share prices.

Another important factor to consider is the level of competition in the cloud computing industry. As more companies enter the market, competition can increase, putting pressure on prices and potentially impacting share prices. Investors should keep an eye on the competitive landscape and how it may affect the performance of cloud providers.

Regulatory changes can also play a significant role in influencing cloud share prices. Government regulations, such as data privacy laws, can impact how cloud providers operate and potentially affect their bottom line. Investors need to stay informed about any regulatory changes that could impact the cloud computing industry and the companies within it.

Market trends and overall economic conditions can also have an impact on cloud share prices. Factors such as economic growth, interest rates, and consumer spending can all influence investor sentiment and ultimately affect stock prices. It is important for investors to consider these external factors when evaluating the potential performance of cloud-related stocks.

Technological advancements and innovation can also impact cloud share prices. As new technologies emerge and cloud providers evolve their services, companies that are able to stay ahead of the curve may see an increase in share prices. Investors should pay attention to developments in the technology sector and how they may impact the competitiveness of cloud providers.

Lastly, investor sentiment and market psychology can also influence cloud share prices. Positive news, earnings reports, or product launches can drive up stock prices, while negative developments can lead to a decrease in share prices. It is important for investors to stay informed and be aware of how market sentiment can impact the performance of cloud-related stocks.

Analysis of Cloud Share Market Trends

Cloud share market trends are constantly evolving, influenced by a myriad of factors such as technological advancements, global economic conditions, and industry regulations. As investors and analysts keep a close eye on the cloud computing sector, several key trends have emerged that shape the market’s direction.

One trend that is particularly noteworthy is the growing demand for cloud services across various industries. As businesses increasingly rely on digital solutions to streamline operations and enhance productivity, the adoption of cloud computing services has surged. This increased demand has driven the growth of cloud share prices, with companies in the sector experiencing significant gains in value.

Another trend that has been observed in the cloud share market is the consolidation of companies through mergers and acquisitions. In a bid to strengthen their market position and expand their service offerings, many cloud computing firms have opted to merge with or acquire other players in the industry. These strategic moves have not only impacted the competitive landscape but also influenced cloud share prices as investors react to the news.

Furthermore, advancements in cloud technology have also played a significant role in shaping market trends. As cloud service providers continue to innovate and develop new solutions to meet the evolving needs of businesses, investors are closely monitoring these developments. Companies that demonstrate a commitment to staying at the forefront of technology are often rewarded with higher cloud share prices, as investors view them as leaders in the sector.

Global events and economic conditions also have a significant impact on cloud share market trends. Factors such as geopolitical tensions, trade disputes, and market volatility can cause fluctuations in cloud share prices as investors react to the uncertainty. It is essential for investors to stay informed about these external factors and consider their potential impact on the cloud computing sector.

In conclusion, the analysis of cloud share market trends reveals a dynamic and ever-changing landscape shaped by various influences. From the growing demand for cloud services to technological advancements and global events, there are numerous factors that drive the movement of cloud share prices. By staying informed and closely monitoring these trends, investors can make more informed decisions about their investments in the cloud computing sector.

Impact of COVID-19 on Cloud Share Prices

The outbreak of COVID-19 has had a significant impact on cloud share prices in the stock market. As the pandemic spread globally, businesses started to rely more on cloud services to enable remote work and digital collaboration. This sudden increase in demand for cloud services caused a surge in the stock prices of major cloud companies, such as Amazon Web Services, Microsoft Azure, and Google Cloud Platform.

As companies began to transition to remote work setups, the need for secure and scalable cloud solutions became paramount. This led to increased adoption of cloud services across various industries, further driving up the demand for cloud stocks. Investors quickly recognized the potential for growth in the cloud computing sector and started pouring money into cloud-related stocks.

However, the initial spike in cloud share prices was not sustained as the economic fallout from the pandemic started to take its toll. Many businesses faced financial difficulties and had to cut back on their IT budgets, including investments in cloud services. This caused a dip in cloud share prices as investors became more cautious about the long-term prospects of cloud companies.

Despite the temporary setback, cloud share prices have shown resilience in the face of the pandemic. The shift towards digital transformation and remote work has accelerated, creating a lasting impact on the demand for cloud services. As businesses continue to adapt to the new normal, cloud companies are expected to play a critical role in enabling digital innovation and driving growth in the post-pandemic economy.

In conclusion, the impact of COVID-19 on cloud share prices has been a mixed bag. While the initial surge in demand for cloud services boosted cloud share prices, the economic uncertainties caused by the pandemic led to a temporary decline. However, the long-term outlook for cloud companies remains positive as businesses increasingly rely on cloud services to navigate the challenges of the digital age.

Comparison of Top Cloud Service Providers’ Share Prices

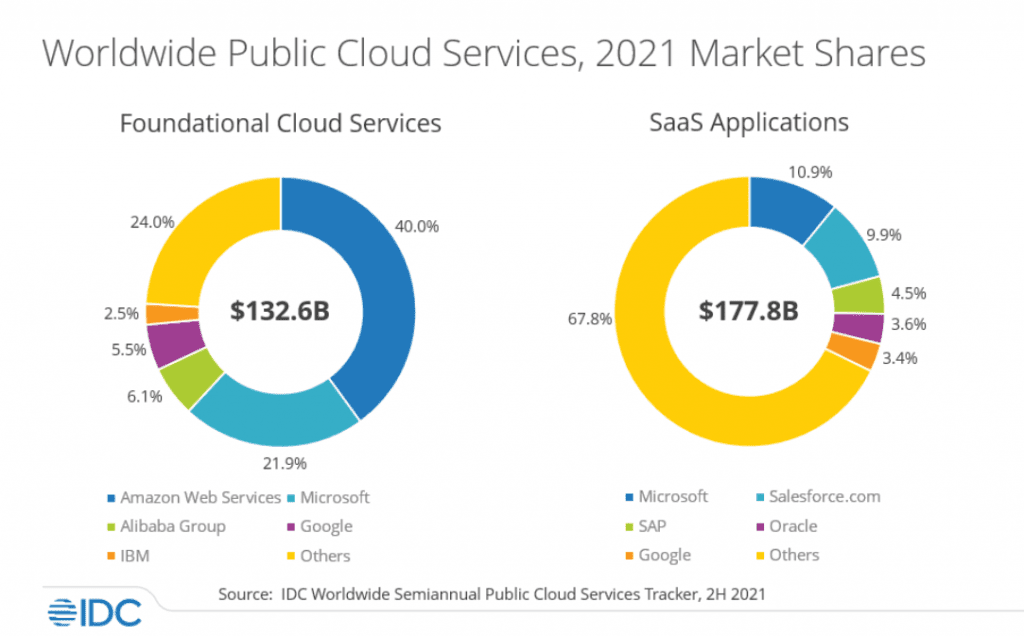

When comparing the share prices of top cloud service providers, it’s important to consider a variety of factors that can influence these numbers. Some of the key players in the cloud computing industry include Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform, and IBM Cloud. Each of these companies offers a range of services and products that cater to different market segments, making them popular choices for businesses seeking cloud solutions.

Amazon Web Services (AWS) is often considered a market leader in the cloud computing industry, with a wide range of services and a strong customer base. As of [insert date], the share price of Amazon (AMZN) was [insert share price], reflecting the company’s position as a dominant player in the market.

Microsoft Azure is another major player in the cloud computing sector, offering a comprehensive suite of services that appeal to businesses of all sizes. As of [insert date], the share price of Microsoft (MSFT) was [insert share price], indicating the company’s strong performance in the cloud services market.

Google Cloud Platform has been gaining traction in recent years, attracting customers with its innovative offerings and competitive pricing. As of [insert date], the share price of Alphabet Inc. (GOOGL), Google’s parent company, was [insert share price], showcasing the growth potential of its cloud services division.

IBM Cloud, while not as well-known as some of its competitors, is still a significant player in the cloud computing space. As of [insert date], the share price of IBM (IBM) was [insert share price], demonstrating the company’s commitment to expanding its cloud offerings and staying competitive in the market.

Overall, the share prices of top cloud service providers can fluctuate based on a variety of factors, including market trends, competition, and company performance. By keeping an eye on these key players and monitoring their share prices, investors can gain valuable insights into the health and potential growth of the cloud computing industry.

Future Outlook of Cloud Share Prices

As we look ahead to the future of cloud share prices, several factors are likely to impact their performance. One key factor to consider is the ongoing trend towards digital transformation in businesses across various industries. As more companies continue to shift towards cloud-based solutions for their IT infrastructure, the demand for cloud services is expected to rise significantly. This increased demand could potentially drive up the prices of cloud shares as investors recognize the growth potential of companies in the cloud computing sector.

Additionally, advancements in cloud technology such as the emergence of edge computing and artificial intelligence are poised to further fuel the growth of cloud shares in the future. Edge computing, for example, allows data processing to occur closer to the source of data generation, enabling faster processing times and reducing latency. As more companies adopt edge computing solutions to enhance their cloud services, the value of cloud shares is likely to increase as investors bet on the potential profitability of companies leading the way in this innovative technology.

Moreover, the ongoing shift towards remote work and the increasing reliance on cloud-based collaboration tools and services are expected to drive further growth in the cloud computing sector. The COVID-19 pandemic accelerated the adoption of remote work practices, prompting businesses to invest in cloud solutions to support their distributed workforce. As remote work becomes more prevalent even post-pandemic, the demand for cloud services is expected to remain high, benefiting cloud share prices in the long run.

Furthermore, regulatory developments could also impact the future outlook of cloud share prices. As governments around the world implement data privacy laws and regulations, cloud service providers may face increased scrutiny over their data protection practices. Companies that can demonstrate compliance with these regulations and maintain high standards of data security are likely to attract more customers and investors, potentially leading to higher share prices in the cloud computing sector.

Lastly, competition among cloud service providers is expected to intensify in the coming years, leading to potential price wars and consolidation in the industry. While increased competition could put pressure on profit margins for some companies, it could also present opportunities for market leaders to expand their market share and drive growth through strategic acquisitions and partnerships. Investors will need to closely monitor the competitive landscape of the cloud computing sector to identify potential winners and losers in the market.

In conclusion, the future outlook of cloud share prices is influenced by various factors such as digital transformation trends, technological advancements, remote work practices, regulatory developments, and industry competition. By staying informed about these key drivers, investors can make more informed decisions about their investments in the cloud computing sector.

Originally posted 2024-06-04 02:09:08.